Production Sharing Contracts & International Petroleum Fiscal Systems

PSC Course

Production Sharing Contracts

& INTERNATIONAL PETROLEUM FISCAL SYSTEMS

Attend The World’s Best Selling PSC Course Held in Over 40 Cities Worldwide to Critical Acclaim!

Dubai 30 June - 3 July 2025

International Venues for 2025

Course Overview

Join the Production Sharing Contracts & International Petroleum Fiscal Systems course, led by Daniel Johnston & Co., to gain critical insights for structuring successful PSC negotiations. This comprehensive course explores all fiscal systems, comparing and contrasting their advantages and disadvantages to help you create the right commercial framework.

Three Exotic Locations to Choose From

- Dubai, 30 June – 3 July 2025

- Cyprus, 8-11 September 2025

- Rio de Janeiro, 6-9 October 2025

Why Attend?

- Gain a deep understanding of global fiscal and contractual arrangements between oil companies and governments

- Learn best practices for petroleum economics, production operations, cost recovery, and revenue-sharing model

- Master state-of-the-art techniques in fiscal system analysis and design

Course Overview

The PSC course goes beyond just PSCs, covering:

- All fiscal and contractual arrangements, including Royalty/Tax, PSCs, Service Agreements & Risk Service Contracts

- Key petroleum industry fundamentals—operations, revenue generation, cost recovery & profit sharing

- Variations such as R-factors, ringfencing, relinquishment, bonuses & goldplating

- Applicability to extractive industries like oil & gas, LNG, deepwater, geothermal, coal-bed methane & more

The course offers 2 Modules over 3.5 days, and delegates

have the option of attending either

Module 1 for 2.5 days or Module 1+2 for 3.5 days.

Course Directors

Daniel Johnston

President & Founder, Daniel Johnston & Co

Daniel Johnston is a globally recognized expert in petroleum fiscal systems, having worked in 44 countrieswith IOCs and NOCs. With over 25 years of experience, he has advised on contract design, negotiations, and economic modelling. Author of multiple industry-leading books, Daniel brings unparalleled expertise to this must-attend course.

Erik Johnston

Vice President, Daniel Johnston & Co

Erik Johnston is Vice President at Daniel Johnston & Co., Inc. and President of Red Point Services LLC. With over two decades of global consulting experience in petroleum economics, fiscal systems, and dispute resolution, Erik has advised on projects worth billions and led professional training worldwide. He's also driven operational growth and innovation in oilfield services. Fluent in English and Spanish, Erik holds degrees in Mathematics, Economics, and Law.

Who Should Attend

Top Management

CEO, VP, MD, GM

Analyst

Policy, Economic, Financial, Business

Professionals

Legal, Financial, Audit, Tax, Geologist, Engineers

Corporate Executives

Policy Developers, Economist

Government

Regulators, Policy Makers

Investors

Bankers, Financial Institutions

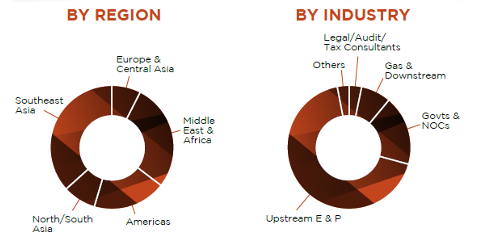

ATTENDANCE 2008 - 2024

Module 1 (2.5 Days)

30 June - 3 July 2025, Dubai

- Economic Rent Theory & Petroleum Taxation

- Commercial Negotiation Strategies

- Global Fiscal Systems & PSC Variations

- Joint Ventures, Rate of Return Contracts & Risk Service Contracts

Module 2 (1 Additional Day)

2 - 3 July 2025, Dubai

- Petroleum Economics & Risk Analysis

- Cash Flow & Expected Value Theory

- Exploration & Development Threshold Field Size Modelling

- Real-world case studies on fiscal system dynamics – Value of Discovery, Value of Reserves in the Ground, Savings Index, Government Participation Analysis & Rate of Return Systems

Delegates are required to bring their own laptop for Module 2.

💡 Bonus: A dedicated spreadsheet toolkit will be provided to assist with cashflow analysis across multiple fiscal structures.

DELEGATES WILL BE REQUIRED TO BRING THEIR OWN LAPTOP

An additional Workbook will be provided as part of the 3rd/4th day cirriculum.

A spreadsheet containing modules for performing cash flow analysis for most of the mainstream types of fiscal systems including:

- Systems with "R factors"

- Rate-of-Return (RoR) based systems

- Production Sharing Agreements, as well as

- Royalty/Tax system and Service Agreements

will be provided.

A WORKING KNOWLEDGE OF EXCEL IS A REQUIREMENT FOR PARTICIPANTS ATTENDING THE 3rd/4th DAY SESSIONS FOR MODULE 2

Extensive Documentation & Research Materials as Study Aids

Module 1

- (420+ pages) with exercises with numerous problems that teach the practical application of petroleum fiscal system analysis.

Module 2

- An additional workbook covering the Computer-based exercises will be handed out to participants signing up for the 3rd/4th day sessions.

- A spreadsheet module for performing cash flow analysis for most of the mainstream types of fiscal system will also be included as part of the course materials for the 3rd/4th day sessions.

- Delegates must bring a laptop for the 3rd/4th day computer-based exercise sessions. If you would like a laptop to be arranged for you, separate rental fees will apply – Contact the PSC Secretariat for details.

Programme at a Glance

- Theory of economic rent

- Taxation theory related to the petroleum industry

- Calculating government take: the common denominator

- Negotiation of commercial terms: key aspects

- Concessionary (royalty / tax) systems

- Production sharing contracts

- Variations on the PSC theme

- Risk service contracts

- Rate of return contracts

- Joint ventures

- Technical assistance / EOR PSCs

- Threshold field size analysis

- The global market for exploration acreage

- Worldwide fiscal systems

- Production sharing contract outline

- Introduction to Petroleum Economics and Analysis

- Cash Flow Modelling & Analysis

- Expected Value Theory

- Exploration Threshold Field Size Analysis

- Development Threshold Field Size Analysis

- Tests for progressiveness (regressiveness)

- Testing “progressive” royalties

- Value of Discovery Exercise

- Value of Reserves-in-the-Ground Exercise

- Dynamics of the Savings Index

- Government Participation Analysis

- Rate-of-return systems